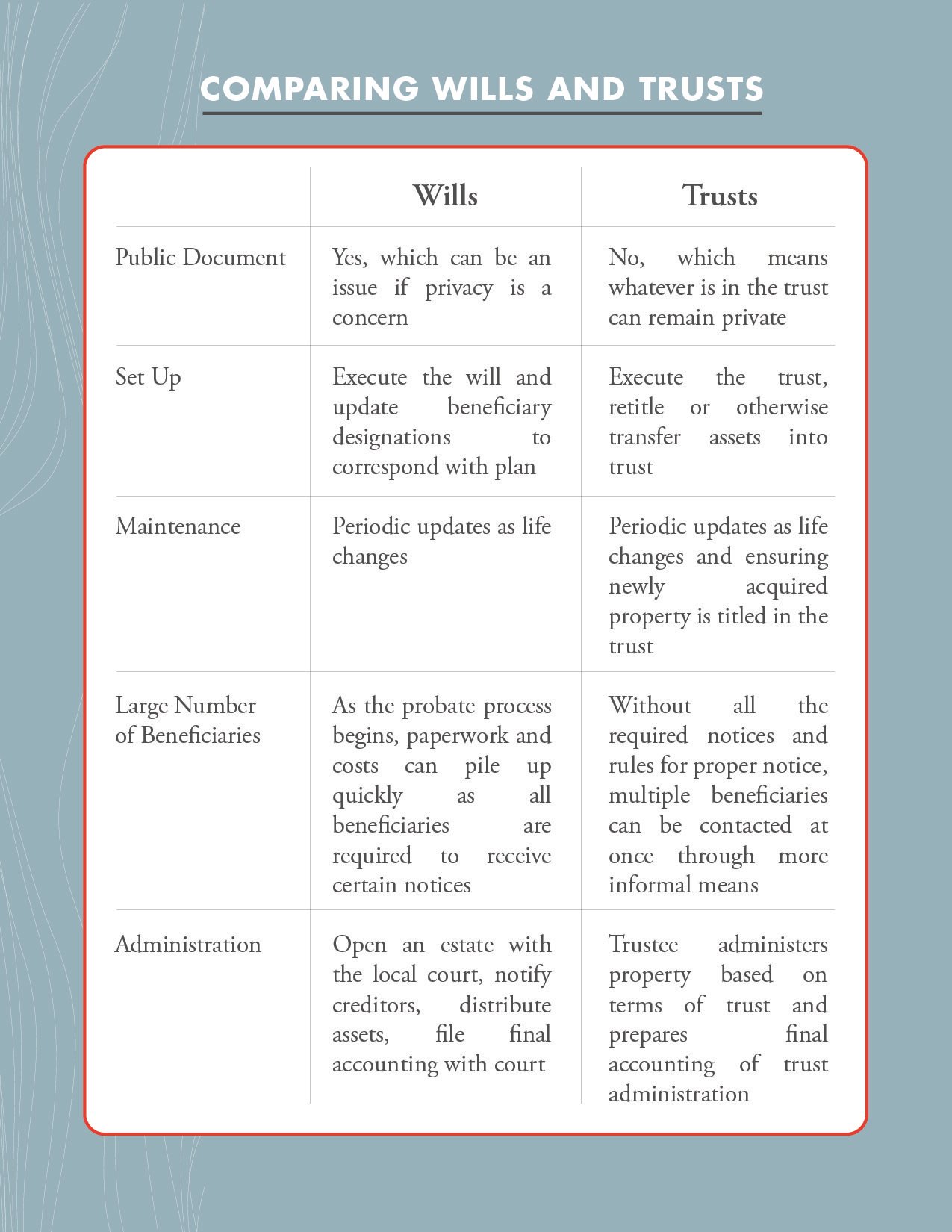

One of the first conversations I have with clients is the difference between using a will and a trust. For most clients, the decision between a will and a trust is about personal preference and which benefits appeal to them most.

For those using a will, they need to decide what they want to happen when they pass and who they want to carry out those decisions (the personal representative). Once the individual passes, the personal representative will open an estate with the local court to begin distributing the property through the probate process. The will is filed with the court and becomes a public document, notice of estate administration is given to potential creditors, and the personal representative makes periodic filings with the court. Due to the strict set of administration requirements, wills tend to take slightly longer to administer and cost a little more to administer than a revocable trust would. One thing to keep in mind when considering a will is that if property is owned in more than one state, the personal representative will need to go through the probate process in each of those states.

Property held in trust avoids the probate process and is administered privately by the trustee, which can be extremely beneficial if property is located in multiple states. While a trust tends to be easier and less expensive after death, they are more expensive to set up because care must be taken to ensure all the individual's property is properly transferred into the trust. If a trust is not properly funded, the probate process will need to be used for any remaining property and some of the advantages of having the trust will be lost. If retitling assets seems like too much of a hassle and a client is just looking to cover what happens in the event of an untimely demise, then a will may suit their situation better.

For more information about estate planning or whether a will or trust makes the most sense for you, please contact us at 765.423.7900 or shoot us an email at info@gutweinlaw.com.