What is basis? Basis is simply the amount you pay for something. Basis is sometimes adjusted by depreciation or undistributed income, but let’s keep it simple. You buy a share of stock for $100. Your basis is $100.

Why does basis matter? Basis matters because it determines the amount of income tax you pay when you sell. If you paid $100 and sell for $150 then you have a $50 gain on which income tax will be due.

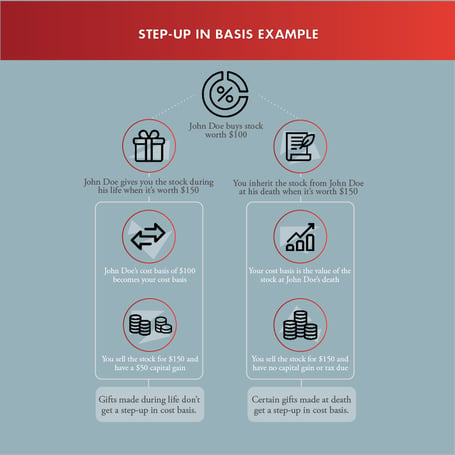

What is stepped up basis? Stepped up basis is what happens when an asset passes upon someone’s death. If you die owning that share of stock and it was worth $150 when you died, your heirs would get a “step up” in basis and their basis would be $150. So, if they sold that share for $150, they would not have any gain and they would not pay income tax on any portion of the sale.

Note that there is no step up in basis if you make a gift while you’re alive. If you give that share of stock worth $150 to your son, it is treated as a $150 gift for gift tax purposes, but your son still has your $100 basis (we call this carryover basis). If your son sells that stock for $150, he will owe income tax on the $50 gain.

To receive a step up in basis, the asset must be a part of someone’s “taxable estate” when they die. This doesn’t mean that any Federal Estate Tax would be due, just that it was subject to tax. Given the large estate tax exemption amounts, most people’s estates will not actually pay any Federal Estate Tax.

We generally talk about having a “taxable estate” when referring to asset values greater than the Federal Estate Tax exemption amount. However, technically any assets we own when we die create a “taxable estate” – but if it is less than the exemption amount then no tax is due (and no Federal Estate Tax return is required to be filed).

Most estate plans consist of a revocable living trust and a pour over will, or just a simple will. Many times beneficiary and payable on death designations can be used to streamline and simplify the administration of someone’s estate. All of these types of “typical” planning result in a step up in basis. Assets passing through these methods are considered to be in the “taxable estate” and continue to receive a step up in basis.

When would something not be part of someone’s taxable estate? Basically, if someone gives up enough control of something they can remove it from their taxable estate. The easiest example is the gift to your son mentioned above. Once you give that share to your son, it is his and when you die that share will not be part of your taxable estate. That seems clear enough, right? Where it gets cloudy is when things are held in irrevocable trusts and not distributed until someone passes.

Irrevocable means you can’t undo or amend it. The primary reason people create irrevocable trusts is for estate tax planning. By using a properly prepared irrevocable trust, we can move some assets outside of your “taxable estate”, thus reducing the assets actually subject to estate tax when you die.

However, there is a tradeoff. Assets removed from your “taxable estate” do not receive a step up in basis on your death. Generally, our advice is to hold on to your assets to the extent that you’re below the estate tax exemption amount and take advantage of the step up in basis.

In a perfect world, you would die with a “taxable estate” consisting of assets equal to your Federal Estate Tax exemption amount, maximizing the step up in basis while avoiding payment of Federal Estate taxes. Like everything in life, perfection is hard to attain.

Have additional questions? Please give us a call at 765.423.7900 or send us an email at info@gutweinlaw.com.