As much as we hate to admit it, sexual harassment is a hot topic right now. From celebrities to large corporations and even startups, it’s everywhere. And regardless of whether you want to discuss it, sexual harassment needs to be talked about with your employees because, let's face it, it's not going anywhere unless we do something about it.

...Read MoreWe have all come across this concept (or is it a term?) before, but now, let’s take the time to really understand this. Over the next few posts in this series, we’ll take a dive into the indemnification pool (pun intended) and break down the useful definitions and considerations to give you enough to have a conversation and lead you into more in-depth research.

In fact, Indemnification Caps (“Caps”) are essential to both buyers and sellers and draw on expertise from litigators and deal lawyers. Are they worth it? You bet, a botched indemnification negotiation could negate the entire value of the deal you just closed. Is it tricky? As you’ll see, the negotiators have their own language.

Let’s start with a broad definition that we can refer back to throughout the series: What is an Indemnification Cap?

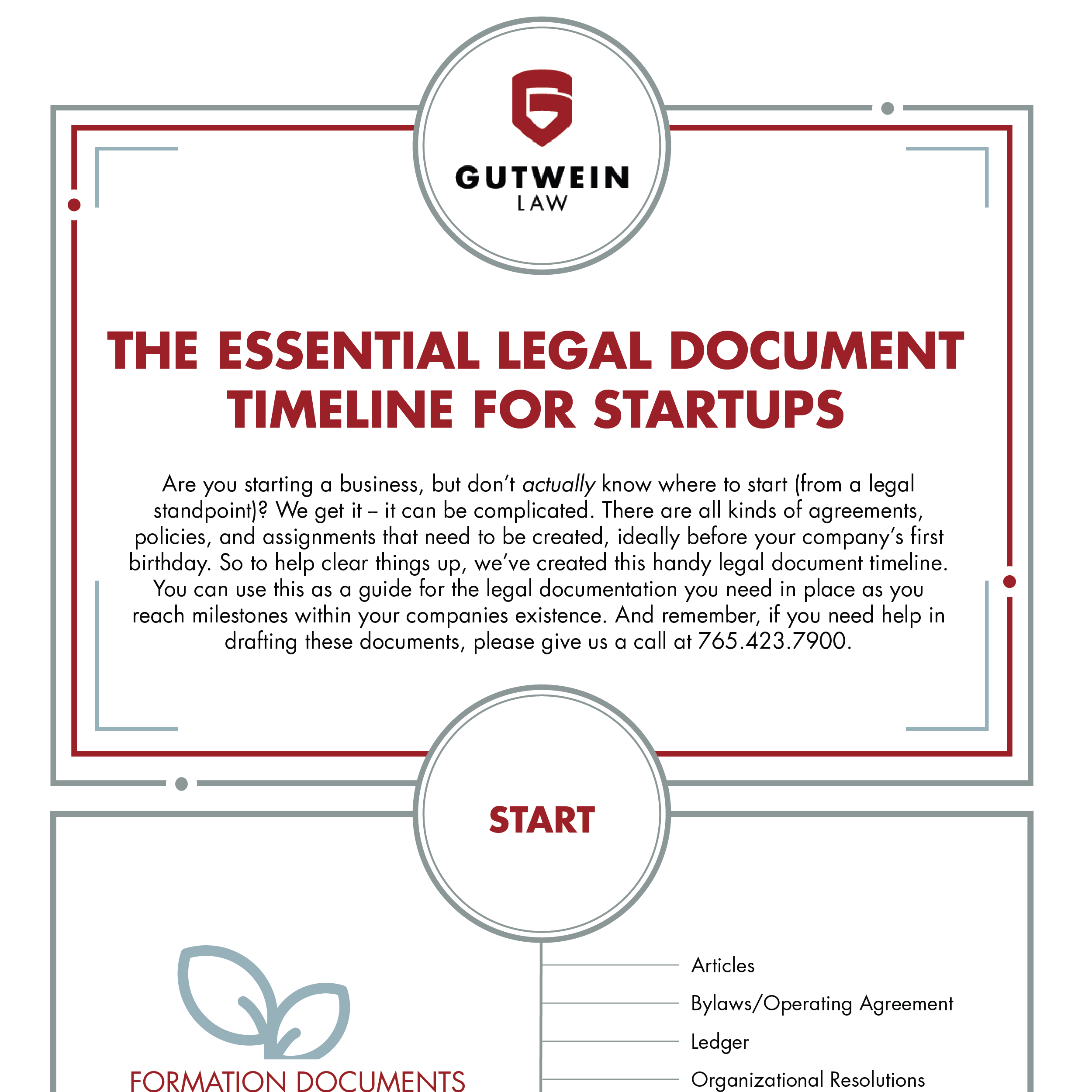

...Read MoreWhen you form a company you need lots of legal documents in place. But how do you know what you need and when you need it? Look no further! We've created this handy legal document timeline just for startups. And as always, please give us a call at 765.423.7900 if you need help getting any of these documents drafted.

...Read MoreLet me start by saying this isn't our typical blog post. There won't be any complicated legal terms or examples. Instead, we want to take this opportunity to place focus on something our clients encounter all the time: networking.

Now I know what you're thinking, "this isn't related to law." And you're right, it's not exactly; but we're also in the business of advising. We'll do whatever we can to help your company grow, so we often go beyond the boundaries of law. After all, many of our team members own businesses themselves, so we know the value of things like networking.

But enough about us. Let's discuss the importance of networking for you as a business person.

...Read MoreWhether you're the "gifter" or the "giftee", it's no secret you want to make the most of a gift. But Federal Estate Tax Laws can make your ideal gifting process a little hard to navigate, to say the least. In recent years, the tax laws have increased the exemption amount (the amount someone can pass without paying any Federal Estate Tax) to approximately $11.2M per person, while the annual gift tax exclusion has increased to $15,000 per person.

While that's a change in your favor, I think it's important to talk through the implications of a gift versus an inheritance. An inheritance, which is a transfer that occurs upon death of the gifter, results in something called “stepped up basis.” A gift made during the gifter’s lifetime results in “carryover basis.”

Let's take a look at a real-world example to help make sense of these two ideas:

...Read MoreAuthor Archive

- Gutwein Law (43)

- Stuart Gutwein (21)

- Andy Gutwein (18)

- Shannon Middleton (17)

- Corben Lee (6)

- Brian Casserly (6)

- Uzair Farooq (6)

- Audrey Wessel (6)

- Sean Farrell (6)

- Tessa Doyle (5)

- Greg Geiser (4)

- Sean McCarthy (4)

- Tessa Steffens (4)

- Karen Young (4)

- Josh Schaub (4)

- Jackie Gessner & Tessa Steffens (3)

- Hayes Cronk (3)

- Tyler Droste (3)

- Joe Delehanty (2)

- Tommi Perdue (2)

- Kaylin Cook (2)

- Shannon Middleton & Karen Young (2)

- Krysta Schilling (2)

- Sophia Khan (2)

- Travis Stegemoller (2)

- Brian Casserly & Cecelia Harper (2)

- Rachel Bir (2)

- Brooke Perez (2)

- Klein Allison (2)

- David Roberts (2)

- Lauren Schrader (1)

- Mitch Bruno (1)

- Andy Gutwein & Laura Vogler (1)

- Brian Casserly & Hayes Cronk (1)

- Chris Shelmon (1)

- Michael Hartman (1)

- Travis Stegemoller & Corben Lee (1)

- Dan Gosnell (1)

- Shannon Starr (1)

- Sheanna Morgan (1)

- Travis Stegemoller & Tyler Droste (1)

- Sierra Murray (1)

- Patrick Fagan (1)

- Stuart Gutwein & Chris Shelmon (1)

- Brian Casserly & Mitch Bruno (1)

- Wes Zirkle (1)

- Chelsie Henderson (1)

- Shannon Middleton and Tyler Droste (1)