Assigning a value to your company is a serious "must-do" for any startup, especially if you're on the hunt for investors. But determining your company's valuation isn’t as straightforward as looking at your bottom line (probably a good thing if you're pre-revenue). It's a blend of science and some art, and there are dozens of valuation methodologies to consider. A quick tip: don't limit yourself to one approach. There's no such thing as the perfect method for your company and utilizing multiple methods allows for an average to be taken, which can help in the negotiation process with investors.

With that in mind, where should you start? Well, there are four valuation methods we think standout among the rest. These should give you exactly what you need the next time you step into the shark tank:

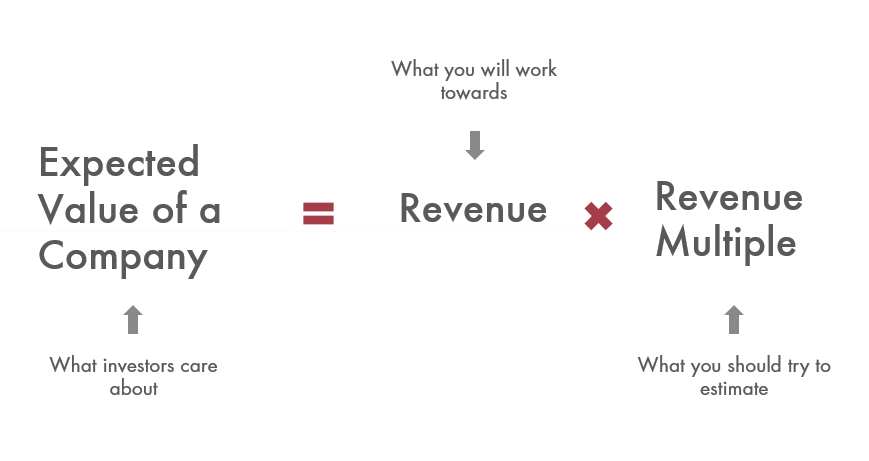

Comparable Transactions MethodThis one's not only our favorite, but it's practically the gold standard of valuation methods. In fact, we recently gave a presentation on this very topic to the gBETA Indianapolis cohort. Hence the name, this method works by comparing your company to other similar companies (i.e., if you're a subscription box fashion brand, compare yourself to Nordstrom's acquisition of Trunk Club). Depending on the industry you're in and the stage of your company, you'll want to examine different comparables or KPI's. For instance, if you're a SaaS company, monthly recurring revenues might be the best figure for you, whereas if you're a social company, active users may be the way to go. Other comparables include number of retail locations, EBITDA, and gross margin. To keep it simple, let's take a look at how you might use revenue as a comparable to determine your valuation.

Source: gBETA Comparable Transactions Presentation

I know what you're thinking: how are you supposed to estimate the revenue multiple or KPI's for other companies? You're going to have to do some digging. Google, press releases, and tools like Pitchbook are your friends during this step. You'll have to get crafty, but finding this information is key to unlocking your company's valuation. Once you have that figure handy, simply multiply it by your company's revenue (or other KPI) to find the solution.

The Berkus Method (Named after Dave Berkus, an American investor and entrepreneur)

This method, which is particularly fitting for pre-revenue high-growth companies (potential to reach $20M in revenue in five years), assigns dollar values to the progress startup founders have made in various aspects of their business. Specifically, it looks at five main points of criteria:

- Quality Management Team: This reflects on the founder(s) and the team itself. Who's involved? Do they have what it takes to execute?

- Prototype: Okay, so the idea is good, but is it possible? Does a prototype exist? Is there any technology risk?

- Sound Idea: First and foremost, what's the potential of the company? What's its basic value? If it can't pass this test, it likely won't be successful long-term.

- Strategic Relationships: How is this product or service getting to market? Is there a clear point of entry? Are there any major competitors in the way?

- Product Rollout or Sales: Even if you haven't gone to market yet, you should probably have some ideas. What does a product rollout look like? Does a sales plan exist?

Before you get carried away, keep in mind each of these factors can only be assigned up to $500k each. So, if you're doing the math, that's a $2.5M maximum valuation of your company.

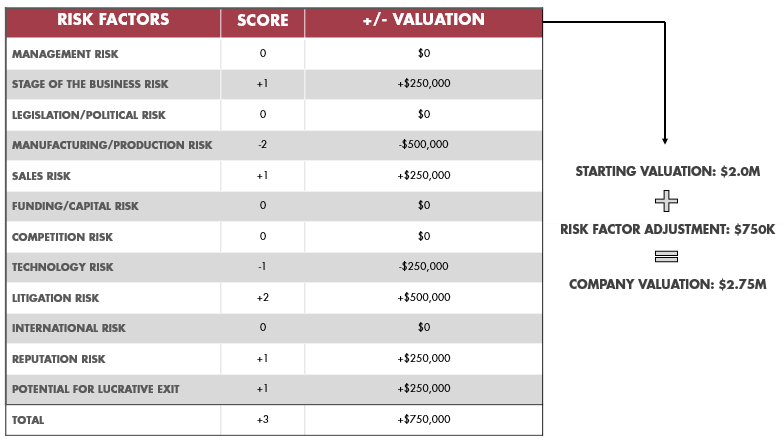

Risk Factor Summation (RFS) Method

In a sense, the Risk Factor Summation Method is a hybrid of the two we just covered. Like The Berkus Method, the Risk Factor Summation Method examines a set of important criteria in pre-revenue companies. The main difference? It starts with a baseline valuation using a comparable (remember the Comparable Transactions Method?) and adjusts for risk factors. The Risk Factor Summation Method also expands on the number of risk factors quite a bit – from five to 12. Here they are:

- Management Risk

- Stage of the Business Risk

- Legislation/Political Risk

- Manufacturing Risk

- Sales and Marketing Risk

- Funding/Capital Raising Risk

- Competition Risk

- Technology Risk

- Litigation Risk

- International Risk

- Reputation Risk

- Potential Lucrative Exit

Once each of the risks above is assessed, it's assigned a score:

- +2 very positive for growing the company and executing a wonderful exit

- +1 positive

- 0 neutral

- -1 negative

- -2 very negative for growing the company and executing a wonderful exit

Then, each score gets converted into a dollar figure based on a simple conversion. For every +1, the company valuation is adjusted positively by $250,000, while every -1 reduces the company's valuation by $250,000. With this thinking, a score of +2 would increase the valuation by $500,000 and a score of negative -2 would do the opposite.

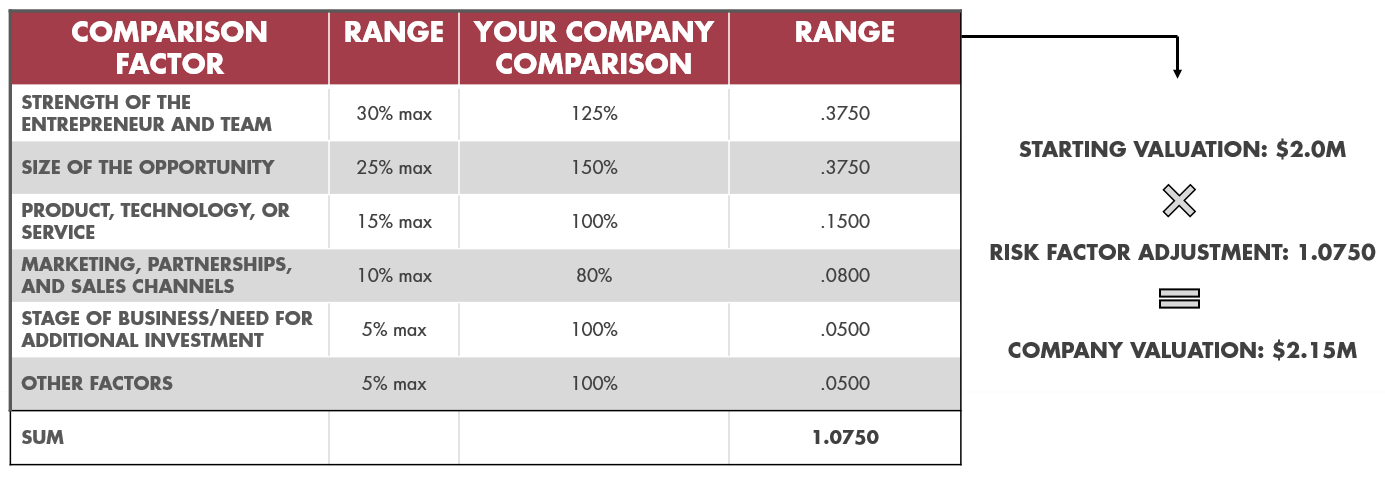

The Scorecard Method

The last method we think is worth your time is called The Scorecard Method (also known as the Bill Payne Method). Just like the Risk Factor Summation Method, you're going to want to start with a baseline valuation before adjusting for various risk factors. However, this time, you'll determine the baseline valuation by examining the average valuation of pre-revenue companies within your geographical region. In most regions, you don't see a lot of fluctuation between business sectors, so that shouldn't impact your numbers too much. To find the average valuation of pre-revenue companies in your geographical region, you'll have to do some looking around (VC firms might have this information handy). You might even find some articles. But for reference, the Angel Market Report by the Center for Venture Research estimated the average deal in 2017 was $3.2M in the U.S. Keep in mind this for the entire U.S., so there's likely some disparity in certain parts of the country.

Now, once you've completed step one, you're ready to start adjusting for risk factors. Again, this method will vary slightly from some of the others as it uses weighted averages to calculate your final valuation number. Here's what you'll need to consider relative to other companies that have completed deals in your region:

- Strength of the Entrepreneur and Team (30%)

- Size of the Opportunity (25%)

- Product, Technology, or Service (10%)

- Marketing, Partnerships, and Sales Channels (10%)

- Stage of Business/Need for Additional Investment (10%)

- Other Factors (15%)

Assume you find the average valuation for pre-revenue companies in your region is $2 million. And you think your company stacks up pretty well compared to other companies that have recently completed deals (strong team – 125% of the norm, weaker sales channels and partnerships – 80% of the norm, etc.). Using the example below, we can determine your company's valuation is $2.15 million.

So that's it. The four valuation methods we live by (and think you should, too). Just remember: try to be as neutral as possible when coming up with your valuations. Because potential investors certainly will remain unbiased when they're choosing how to invest their money.

As we mentioned earlier, there are quite a few other methods out there, so don't be surprised if you see some different names mentioned. For instance, the Venture Capital Method is often used by – you guessed it – venture capitalists. It's not necessarily a method in determining your company's value, rather a way for venture capitalists to determine how to invest their money. So, it's still important to understand. The hard and fast rule is that they require roughly 20% returns, and assume 80% of investments fail, 10% return money, and 10% succeed. That 20% required return is then applied to your company to determine what percentage of the exit valuation is needed to accomplish their goal, and what valuation that would imply. You need to do everything you can to prove to venture capitalists you fit into the "10% that will succeed" category.

We won't bore you by going into detail on these other methods as they're less common, but the Book Value Method, Liquidation Value Method, Discounted Cash Flow Method, and First Chicago Method exist and are sometimes utilized.

If you have questions about these less common methods, or anything at all we covered here, please give us a shout. There's a lot to consider when valuing your company and it's a pretty important step in your journey to seeking investors. We can be reached via phone at 317.777.7920, or through the contact form on our website: http://gutweinlaw.com/contact-us.